By: Kenneth Appiah Bani.

The 2024 KPMG Customer Experience Survey has shed light on the cautious investment behavior of Ghanaians, reflecting a preference for low- to medium-risk opportunities as individuals navigate economic challenges while pursuing financial security and independence.

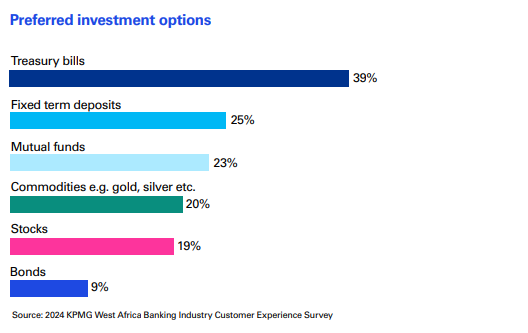

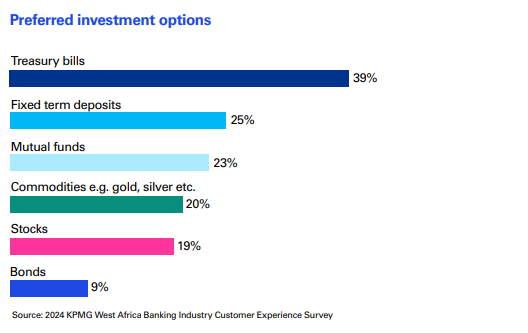

The survey revealed that treasury bills remain the most popular investment option, with 39% of respondents choosing these low-risk instruments. Fixed or term deposits closely followed, attracting 25% of respondents, further highlighting the preference for stability and guaranteed returns in uncertain economic times.

Despite this conservative trend, the report pointed to a gradual diversification of investment choices. Mutual funds, selected by 23% of respondents, are gaining traction as a medium-risk option that offers balanced returns. Additionally, commodities such as precious metals and agricultural products were chosen by 20% of respondents, indicating a growing interest in alternative investments as a hedge against inflation and economic instability.

In contrast, higher-risk instruments such as stocks (19%) and bonds (9%) remain underutilized, signaling limited confidence in these options. The report emphasized the need for financial institutions to educate the public and demystify complex financial products, bridging the knowledge gap and encouraging more diversified investment strategies.

Interestingly, while many Ghanaians remain cautious, 34% of respondents expressed a willingness to take on higher risks, signaling an underlying desire for wealth creation and long-term financial independence.

The survey also explored how Ghanaians allocate their resources beyond traditional investments. About 24% of respondents are investing in skill acquisition and business ventures, reflecting a strong drive for career growth and financial independence.

Family obligations emerged as a central priority, with 24% of respondents dedicating resources to education, healthcare, and general family welfare. Meanwhile, 22% of respondents are pursuing wealth generation through investments and property sales, highlighting the growing importance of long-term financial strategies.

These findings underscore a multifaceted approach by Ghanaians, balancing caution in traditional investments with a focus on personal growth, family responsibilities, and alternative income streams. As economic conditions evolve, this trend signals a shift toward more diverse strategies for achieving financial security and independence.

Credit:KPMG Survey