By: Kekeli K. Blamey

Ghana’s oil sector has recorded a significant 33% decline in surface rental revenue for the first half of 2024.

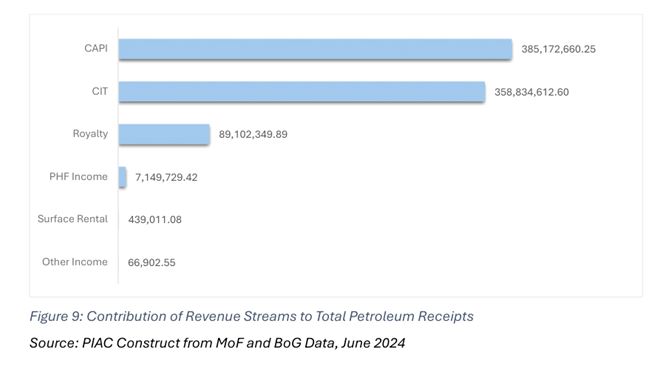

Despite this decline, the country saw a 55.6% increase in total petroleum receipts for the same period, reaching a total of US$840,765,266, the highest revenue recorded to date.

According to the Public Interest and Accountability Committee (PIAC), the decline in surface rental revenue is attributed to payment delays by key players in the sector, including Goil Upstream Limited, Springfield Exploration Limited, and Medea Development Limited.

These companies have cited various reasons for the delays, including ongoing negotiations and financial difficulties.

The total Surface Rentals receipt of US$439,011 represents a 33 percent decrease compared to the US$659,118 collected during the same period in 2023.

This has led to an increase in Surface Rental arrears of US$1.2million excluding that of the terminated Petroleum Agreements (PAs).

The Ghana Revenue Authority (GRA) has attributed the decline to various factors, primarily payment delays by key players in the sector.

Goil Upstream Limited failed to pay its 2024 acreage fees citing ongoing negotiations to integrate outstanding liabilities inherited from Exxon Mobil. Exxon Mobil lately vacated its oil block, leaving arrears that Goil Upstream is now grappling with.

Additionally, Springfield Exploration Limited – a significant contributor to surface rental revenue, is yet to settle its liabilities despite receiving demand notices.

Financial difficulties faced by Medea Development Limited are said to have further compounded the shortfall.

Medea is reportedly in discussions with the Ministry of Energy to secure a suitable partner, which could stabilise its operations and improve its ability to meet financial obligations.

The Public Interest and Accountability Committee (PIAC) has emphasized the importance of timely payments to sustain public revenue streams.

The committee has also called for strengthened enforcement mechanisms to ensure compliance by industry players.

PIAC, in its latest report, reiterated that the Ghana Revenue Authority (GRA) should take immediate steps to recover the Surface Rentals outstanding and also ensure that Surface Rentals assessed be paid into the Petroleum Holding Fund (PHF) not later than 28th February of each year, as provided in Regulation 5 (1) (b) of Legislative Instrument (L.I.) 2381.

According to PIAC, the Compliance, Enforcement and Debt Management (CEDM) Unit of GRA has issued garnishee orders on some defaulters.

One of the four defaulters, Sahara Energy Limited who had their PA terminated, is reported to have paid its principal liability of US$71,935 in 2022 – taking advantage of the Tax Amnesty granted taxpayers to have its penalty of US$21,943,750 waived by the Commissioner General in accordance with the law.

PIAC also reported that GRA indicated a misclassification of Corporate Income Tax payment on 24th April 2024 totalling US$141,938 from Kosmos Energy Gh.

The anomaly, however, did not affect the total sum in the PHF for the period under review but was duly brought to the Bank of Ghana’s (BoG) attention.