Credit: Kekeli K. Blamey

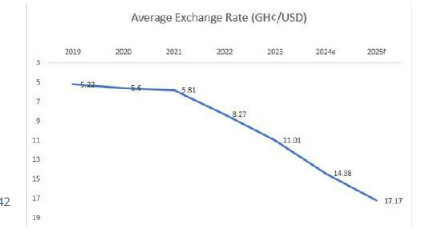

The Ghanaian cedi is expected to end 2024 at GH¢16.07 to one US dollar, before depreciating further to GH¢17.23 by the end of 2025, according to the latest forecast by the Economist Intelligence Unit (EIU).

This forecast was captured in Deloitte’s Report titled “Sneak Preview of 2025.”

According to the EIU, the cedi’s depreciation in 2024 will be driven by a decrease in cocoa exports and a higher import bill.

However, the unit expects improved investor confidence in 2025, driven by a relatively peaceful election, the conclusion of the government’s debt restructuring negotiations, periodic International Monetary Fund (IMF) disbursements, and higher gold export receipts.

These factors are expected to boost the country’s international reserves and support the cedi’s value. As of now, the cedi is trading at GH¢16.10 to one US dollar on the retail market. A stable exchange rate is positive for restoring investor confidence in the economy, according to Deloitte. However, risks to a stable cedi include a rise in imports from the services subsector, such as hydrocarbons and mining projects, as well as a more-than-anticipated decline in cocoa exports.

A decline in cocoa exports could lead to a narrower trade surplus and a decline in the current account balance. According to Deloitte, Ghana’s current account balance is forecast to decline to US$700 million in 2025 from an estimated US$1.6 billion in 2024.

The EIU’s forecast is based on its analysis of Ghana’s economic trends and outlook. The unit expects Ghana’s economy to grow at a rate of 5.2% in 2024 and 5.5% in 2025, driven by improvements in the agriculture and industry sectors. However, the unit also expects inflation to remain high, averaging 12.5% in 2024 and 10.5% in 2025.

Overall, the EIU’s forecast suggests that Ghana’s economy will continue to face challenges in the coming years, but that the country has the potential for strong growth and development.