By: Kenneth Appiah Bani

The International Monetary Fund (IMF) has revealed that Ghana is performing far below its tax potential compared to its peers in Sub-Saharan Africa, stressing the need for stronger revenue mobilisation measures to support economic recovery and long-term growth.

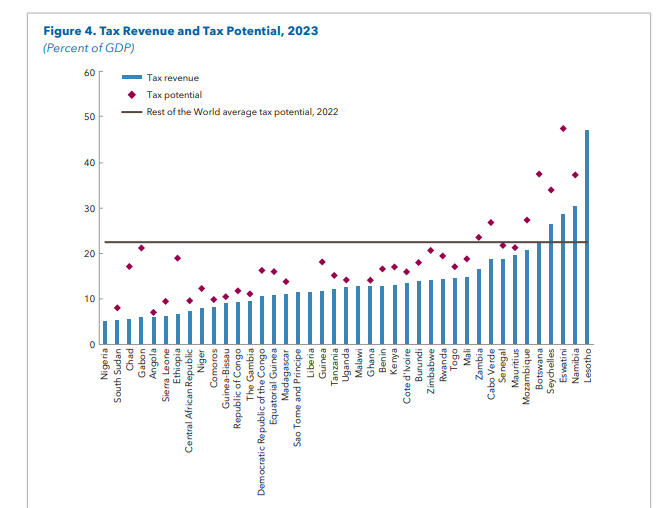

According to the IMF, Ghana has the capacity to generate significantly higher domestic revenue than it currently does, especially through improved tax compliance, reduction in leakages, and effective broadening of the tax base. The Fund noted that the country’s tax-to-GDP ratio remains one of the lowest among middle-income and resource-rich countries in the region, despite recent efforts to introduce new tax measures.

The IMF highlighted that Ghana lags behind many African countries that have successfully strengthened their revenue mobilisation. As of 2022, 18 countries in Sub-Saharan Africa have a revenue-to-GDP ratio above 13% the minimum level required for accelerated growth and development. Ghana’s current performance, however, remains below this threshold, limiting the nation’s ability to finance key development priorities.

The report observed that while Ghana has rolled out reforms such as the e-VAT invoicing system and the streamlining of tax exemptions, revenue outcomes still fall short of the country’s economic potential. Weak enforcement, administrative bottlenecks, and widespread informality continue to undermine effective domestic revenue mobilisation.

The IMF emphasised that enhancing tax revenue is crucial for reducing Ghana’s dependence on borrowing, stabilising public finances, and funding critical sectors such as health, education, and infrastructure. Closing the tax gap, it noted, would significantly ease fiscal pressure and support Ghana’s economic recovery under the ongoing IMF-supported programme.

To improve revenue performance, the Fund recommended intensified digitisation of tax administration, strengthening of the Ghana Revenue Authority (GRA), reduction of tax exemptions, and the promotion of fairness in the tax system to encourage public compliance. It further advised the government to improve communication on tax policies to build trust and boost cooperation.

As Ghana continues to navigate economic challenges, the IMF’s findings provide a timely reminder of the urgent need for consistent and coordinated reforms to unlock the country’s full revenue potential.