By: Kenneth Appiah Bani

Data from the Bank of Ghana’s Annualised Percentage Rates (APRs) for 1-year household loans shows a significant shift in lending rates between September 2024 and June 2025, with several banks sharply increasing their charges to customers.

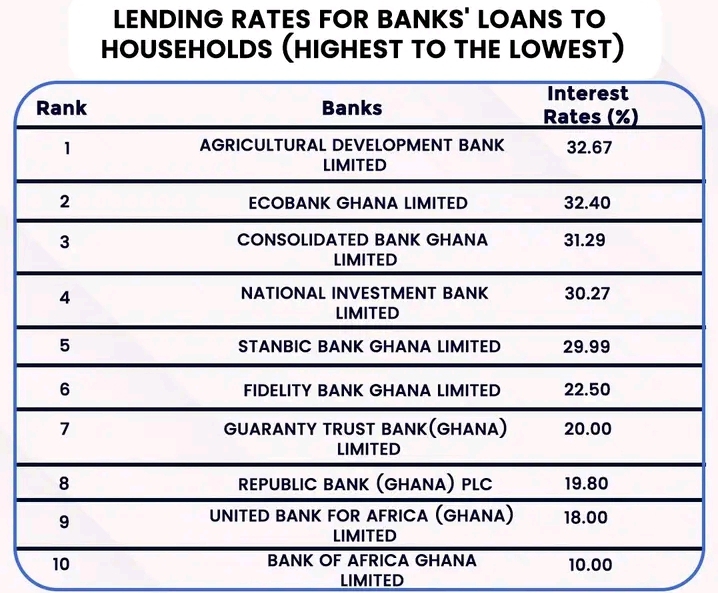

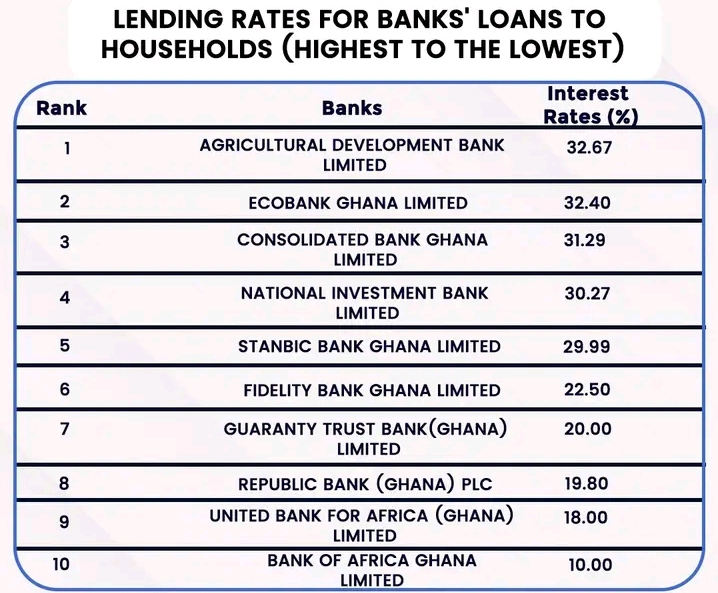

In September 2024, the Agricultural Development Bank Limited topped the list with a rate of 32.67%, followed closely by Ecobank Ghana Limited at 32.40% and Consolidated Bank Ghana Limited at 31.29%. The lowest rate during that period was offered by Bank of Africa Ghana Limited at 10.00%.

By June 2025, the rankings changed dramatically. National Investment Bank Limited, which had charged 30.27% in September 2024, surged to 43.61%, becoming the most expensive lender to households. United Bank for Africa Ghana Limited jumped from 18.00% to 36.00%, and First National Bank Ghana Limited entered the top tier with 35.69%.

Some banks saw less drastic increases but still climbed higher. Agricultural Development Bank rose from 32.67% to 34.68%, Ecobank from 32.40% to 32.63%, and Guaranty Trust Bank Ghana Limited from 20.00% to 35.00% a steep jump of 15 percentage points.

Meanwhile, Bank of Africa Ghana Limited, despite an increase from 10.00% to 16.00%, retained its position as the lowest lender among the top 10 in June 2025.

The data underscores the rising cost of borrowing for Ghanaian households, with interest rate hikes reflecting broader economic conditions and tighter credit environments. Financial analysts warn that such increases could strain household budgets, discourage loan uptake, and slow consumer-driven growth, while banks point to inflationary pressures and monetary policy adjustments as key factors driving the changes.