By: Kenneth Appiah Bani

Mining milestone expected to boost Ghana’s gold production and local jobs.

In a major boost to Ghana’s mining industry, Engineers & Planners, led by its Chief Executive Officer Ibrahim Mahama, has secured a $100 million facility from the ECOWAS Bank for Investment and Development (EBID) to acquire the Black Volta Gold Project. The landmark deal signals growing investor confidence in the country’s natural resources sector.

The acquisition, officially signed during a high-profile ceremony attended by key industry stakeholders, marks a significant milestone in Ghana’s ongoing efforts to expand its gold production and local mining capacity. The deal is expected to create jobs, increase domestic gold output, and encourage further investment in the extractive sector.

Veteran Ghanaian businessman and statesman, Sir Sam Jonah, who was present at the signing, dismissed suggestions that the transaction was politically motivated. According to him, the agreement is purely merit-based and grounded in commercial viability. “This acquisition is a sound business decision, not a political arrangement,” Sir Sam stated.

Mining experts and observers have praised the move, highlighting the potential economic benefits and the opportunity for increased local participation in a sector long dominated by multinational firms. With Ibrahim Mahama at the helm, Engineers & Planners is set to play a pivotal role in the future of Ghana’s mining development.

Project Highlights and Resource Potential

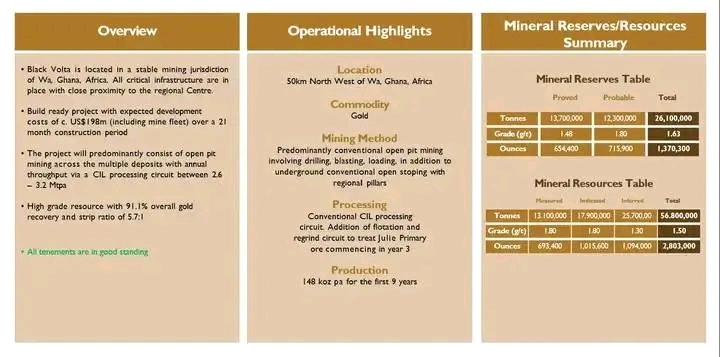

The Black Volta Gold Project is located in a stable and mining-friendly jurisdiction approximately 50 km northwest of Wa, Ghana. With proximity to the regional capital and existing critical infrastructure, the site is considered a “build-ready” project with an estimated development cost of US$ 198 million and a 21-month construction period.

Mining operations will be predominantly open pit, using conventional methods such as drilling, blasting, and loading. In addition, there will be underground mining via conventional open stoping with regional pillars. The processing will follow a conventional CIL (carbon-in-leach) circuit and include crushing, milling, and gold recovery facilities. The design also allows for expansion to treat ore from the nearby Julie Primary deposit once operations begin in year 3.

Expected annual production is 148,000 ounces of gold for the first five years, with a high overall gold recovery rate of 91.1% and a strip ratio of 5.7:1 all indicators of strong project economics.

According to the Mineral Reserves and Resources Summary:

The Proven and Probable Reserves total 26.1 million tonnes at an average grade of 1.63 g/t, amounting to approximately 1.37 million ounces of gold.

The Measured, Indicated, and Inferred Resources total 52.68 million tonnes at an average grade of 1.50 g/t, translating to about 2.83 million ounces of gold.

All tenements associated with the project are currently in good standing, further strengthening the credibility and long-term viability of the investment.

With this bold move, Ibrahim Mahama and Engineers & Planners are positioning themselves as key players in Ghana’s gold mining sector, while advancing the broader goal of African ownership in strategic resource development.

Video credit:1957news

Watch the video of Sir Sam Jonah speach at the event: