By:Kenneth Appiah Bani.

Ghana’s pension industry is facing systemic vulnerabilities due to underdeveloped capital markets and a persistent lack of viable investment alternatives, according to Afriyie Oware, CEO of Axis Pension Trust.

Despite multiple regulatory efforts to encourage portfolio diversification, the sector remains heavily dependent on government securities. As of 2023, approximately 83 percent of pension assets were allocated to government bonds a marginal decrease from the 84 percent recorded during the post-financial sector clean-up period.

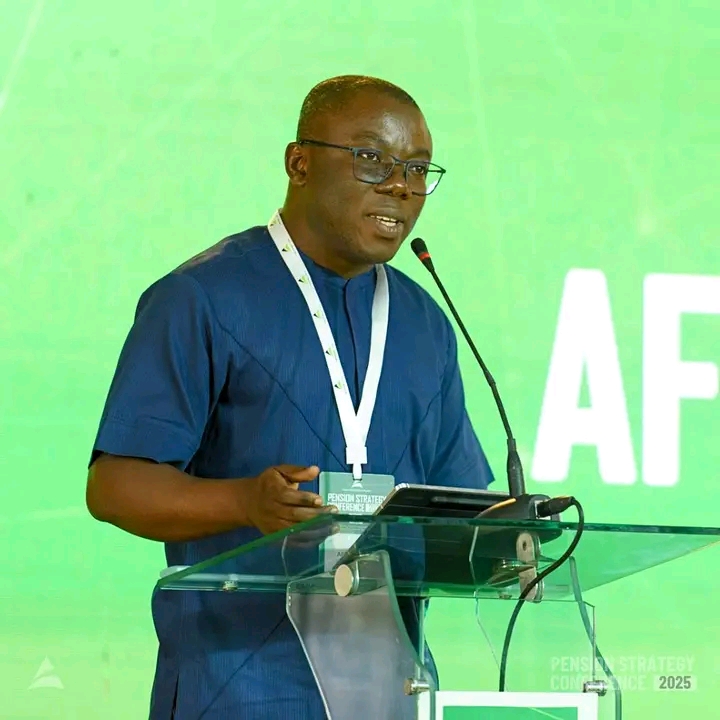

Speaking at the 2025 Pension Investment Strategy Conference, Mr. Oware emphasized that weak market structures are impeding diversification and increasing the industry’s exposure to sovereign debt.

“This is a symptom of a deeper problem,” he stated. “It is not the government’s responsibility to create investment assets for the pension industry.”

Tracing the sector’s evolution, Mr. Oware described three distinct phases: a conservative beginning, a shift toward risk aversion post-2017, and the current phase of structural stagnation. Although recent years have seen updated investment guidelines and the rollout of lifecycle funds, trustees continue to struggle with diversification due to a lack of investable options in the domestic market.

“The fundamental error has been the assumption that our financial markets are mature enough to support proper diversification,” he said. He described trustees’ preference for government securities as a rational decision in an irrational system that lacks credible investment alternatives.

Ghana’s equity market remains underutilized, with only 3 percent of pension assets allocated to listed equities. The corporate bond market is even less developed, accounting for just 1.5 percent of total bond market activity.

Investor confidence has also been shaken by high non-performing loan rates now above 24 percent and the collapse of several key state-owned enterprises. These factors have made it difficult for pension funds to channel capital into the private sector.

“There is a structural mismatch between available capital and bankable investment opportunities,” Mr. Oware explained. “You cannot diversify if there’s nowhere else to invest.”

To address these challenges, Mr. Oware proposed a six-point reform agenda that includes: strengthening equity and corporate bond markets, revitalizing municipal finance, and unlocking real estate investments through land use reforms. He also stressed the need to formalize Ghana’s fragmented money markets by creating organized platforms for negotiable fixed deposits and commercial paper.

“Without these structural changes, pension funds will keep investing in the parasite instead of the host,” he warned, criticizing the disproportionate exposure to public debt at the expense of real sector growth.

Mr. Oware also called for a new approach to state capitalism, urging the government to leverage its borrowing capacity for commercially viable public-private partnerships that can attract pension financing. He cited the Twifo Oil Palm Plantation as a successful model.

While welcoming pledges of fiscal responsibility from President John Dramani Mahama and macroeconomic prudence from the Bank of Ghana, Mr. Oware underscored the importance of trustee-led reforms.

“Our choices as trustees will determine whether we entrench economic fragility or build sustainable prosperity,” he concluded.

The 7th edition of the Pension Strategy Conference brought together thought leaders, policymakers, and industry stakeholders for a day of high-impact dialogue. Through engaging panel sessions and visionary keynote addresses, Axis Pension Trust reaffirmed its commitment to building a resilient and sustainable pension ecosystem for Ghana.